River Valley Loans: Complete Guide for quick loan

In today’s fast paced era, everyone wants everything instantly, be it a loan or anything else.People often look for where they can get an instant loan that can meet their emergency financial needs.Today we are going to look at one such loan which is a quick and instant loan that you can easily avail in just a few steps.

River valley lons is a lending service offer personal installment loans to borrowers who want immediate money.

Basically these loans are designed for emergency such as medical bills car repairs and others. In this article we will explore everything about river valley loans so that it will clarify your all doubts related to the loan.

How to get River Valley Loans?

To get River Valley Loan is very easy and straightforward process

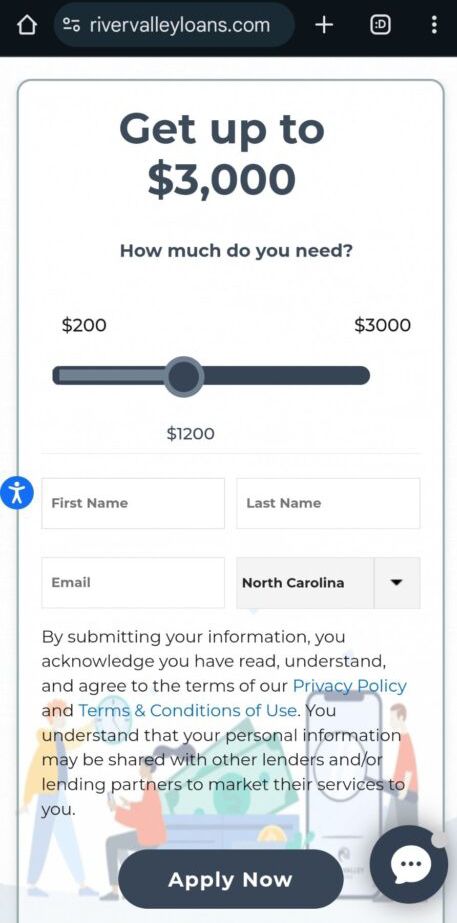

Go to official website

In the first step you have to go to the official website of River Valley.

Check for desired loan option

Check for the desired loan options given according to your financial goals you have to select the loan

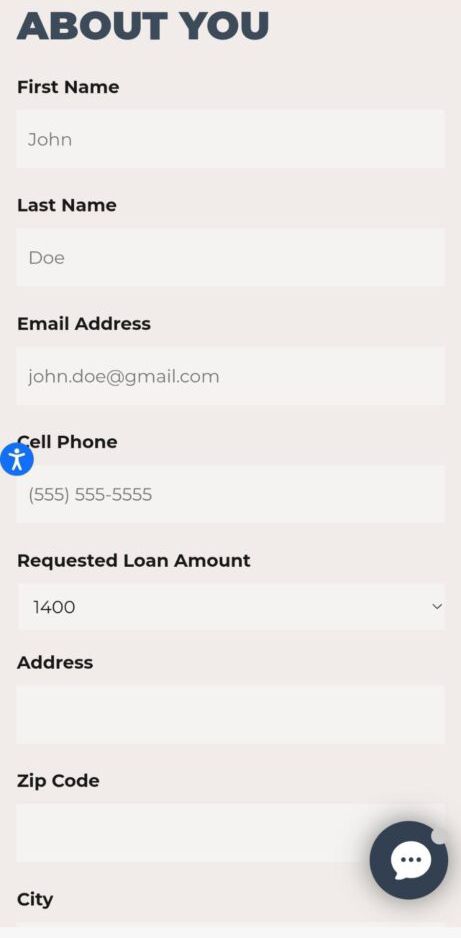

Submit all information

Submit all the information required like personal details along with desired amount.

Get verified and submit the application

Submit all the details required you will get loan instantly.

FAQs: River Valley Loans

1. What is the eligibility criteria for River Valley Loans?

Be at least 18 years old.

Have a steady income.

Possess an active checking account and valid identification.

2. How long does it take to receive funds?

Approved loans are generally deposited within 24–48 hours.

3. Can I repay my loan early?

Yes, borrowers can repay their loans early without prepayment penalties.

4. What is the interest rate for River Valley Loans?

Interest rates vary between 200% and 700% APR depending on loan terms and state regulations.

5. What happens if I miss a payment?

Missing a payment may result in additional fees and impact your credit rating.

People Also Ask

1. Are River Valley Loans safe to use?

River Valley Loans follows federal regulations and offers secure application processes, making it a legitimate lender.

2. Do River Valley Loans check credit?

They may perform a soft credit check but focus more on income and repayment ability than credit score.

3. What states does River Valley Loans operate in?

Loan availability depends on state laws. Visit their website for a complete list of states.

4. Can I get a loan if I’m self-employed?

Yes, as long as you can provide proof of consistent income.

Tips for Responsible Borrowing

1. Borrow Only What You Need

Avoid over-borrowing to minimize repayment burdens.

2. Understand the APR

High-interest rates mean paying back significantly more than borrowed.

3. Read the Terms

Review loan agreements thoroughly to avoid hidden fees.

4. Budget for Payments

Ensure you have enough funds for each installment to avoid late fees.

Conclusion

River Valley Loans is a viable option for individuals needing quick cash but comes with high-interest rates. Borrowers should weigh the urgency of their financial needs against the cost of the loan. Always consider alternative funding sources or financial counseling if possible.

For more information, visit the River Valley Loans website

Also Read This

A Complete Guide to Kohl’s Credit Card Payment in the United States