LendKey Home Improvement Loans: Detailed Guide To Improve Your Home

When it comes to improving your home, whether it’s kitchen space, more living space or making energy efficient upgrades, the cost associated with home improvement can quickly escalate. Home improvement projects can be big or small. These projects are an investment in your properties’ future value and your quality of life.

Some people always think that funding for home improvement can be a challenge to overcome the challenge of home improvement loans coming into play.

In this article LendKey Home Improvement Loans we are going to explore LendKey home improvement loans, how they work, what is eligibility and why this option is the right option for your renovation project, so here we go!

What is Home Improvement?

It is the dream of every person to have a nice house and to do the interiors as per their choice and improve the home as per the wishes of the family members.

The desire of many people to do home improvement remains unfulfilled because doing home improvement is not that easy these days.

Everyone is fond of home improvement. A home improvement loan is available to fulfill their wish.

Home improvement loan is a kind of loan which A significant value to your property and enhances your living space, making it comfortable for your family members.

Some elderly people are there who provide home improvement loans to their customers. Here we are going to see LendKey Home Improvement loans.

Types of Home Improvement loans

- There are three types of Home Improvement loans

- Unsecured loans

- Secure loans

- Guarantor loans

Unsecured Loans: UN secured loans do not require any asset such as collateral the lander can chase you if you fail to make payments.

Secure loans: secure loans require assets like home equity as collateral, giving more assurance to the lender.

Guarantor Loans: If you don’t have a good credit rating, then you will get a loan independently with the help of a guarantor loan.

Payment period for the home improvement loan varies from 1 to 5 years.

What is LendKey?

LendKey is a financial technology platform that connects borrowers with a network of community leaders. Land ki is a not a bank that is going to give you a loan day to assist banks and credit unions with successful online lending.

LendKey provides low-cost borrowing options in online lending, transforming the 3.2 trillion dollar consumer lending market.

LendKey, established in 2009, aims to simplify the borrowing process while giving borders easy access to lower rates and better terms that they might find at traditional large banks.

The home improvement loans of LendKey are designed to help homeowners fund renovations without going into their home equity.

Benefits of LendKey Home Improvement Loan

LendKey offers home improvement loans and has various benefits, such as

Low rates and great terms

This offers their customers an alternative to cash on hand with great rates. The term period for the loan is as long as 15 years.

No fee financing

LendKey will not take any small financing, which will make their customers happy.

Dedicated customer service

LendKey provides best-in-class customer service to deliver a good experience. Whenever they want to connect with their customer service easily, they have provided a contact number so they can contact customer service.

Customer benefits

Generally, loan providers give secured loans, but here LendKey is providing unsecured loans with a fixed APR that can be prepared without penalty at any time, so this is a good thing for the customers.

General home improvement eligible

All the general home improvements are eligible without meeting certain criteria are eligibility measures to qualify for the financing.

Customizable funding

Usually, other leaders will not give the maximum qualified amount to their customers, but here, with LendKey, they provide customers for the maximum qualified amount, which allows for flexible funding.

No need for home equity

One of the most significant advantages of using LendKey for your home improvement loan is that you don’t need to have built up home equity to qualify. A good opportunity for new homeowners.

Flexible loan use

LendKey improvement lawns can be used for multiple projects including

- Kitchen and bathroom modification

- Solar panel or new window enhancement

- Roof replacement

- Outdoor and garden improvements

- Finding an existing room available.

How to apply for LendKey Home Improvement Loan

The application process to apply for a home improvement loan at LendKey is a very easy and user-friendly process. Here are some steps involved.

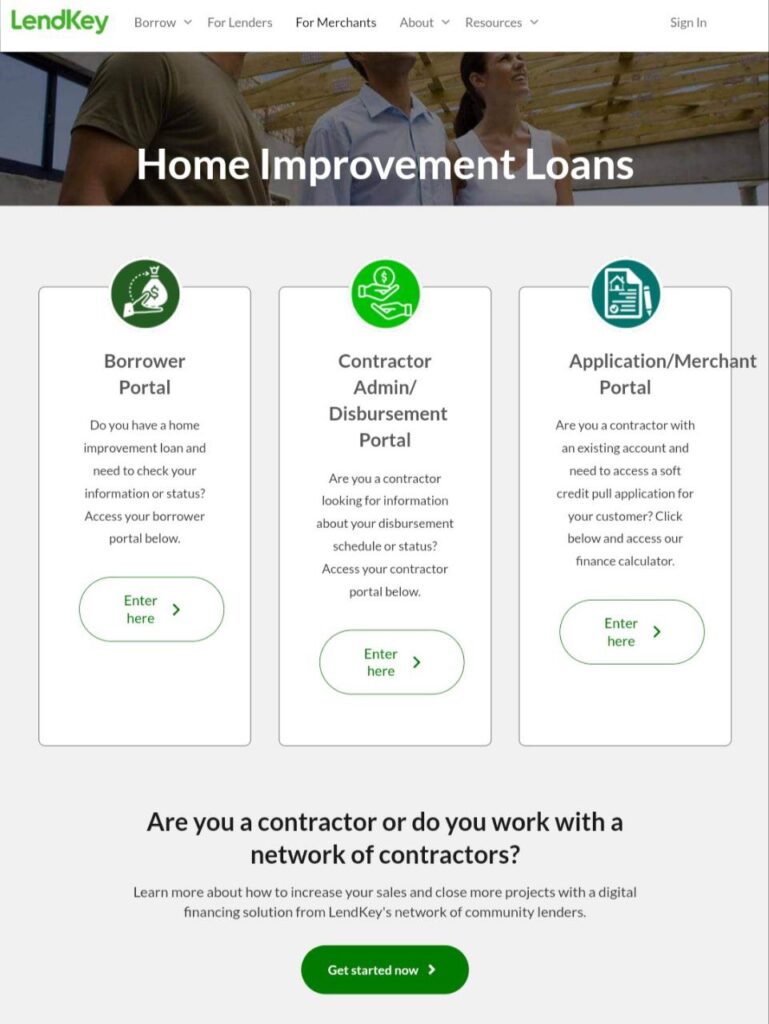

When you go to the official website of LendKey you will see three options.

- Borrower Portal

- Contractor disbursement portal

- Application or merchant portal

In which category you will fit, depending on that you have to choose an option.

Connect Official website

The first step is to go to the official website of LendKey. Here we provide a link for the same to you have to click on to apply a simple application form with details about yourself and your home improvement project.

Review loan Offers

Once you have submitted all your personal information, LendKey will match you with a potential lender which will be suitable for your needs. You can then compare your rates, don’t term and other factors with the lenders

Choose a suitable offer

Once you get all the details, you have to choose a suitable offer according to your needs and wait for approval.

LendKey does not give you any money. They will connect you with lenders based in the market for your home improvement loan.

Eligibility and requirements for LendKey home Improvement Loans

To qualify for the LendKey home improvement loan, you have to go through some eligibility criteria which includes

Credit score

Income and debt to income ratio

United States citizenship or residency

Valid Identification

Conclusion

LendKey home improvement loans offer a variety of services which are flexible and cost-effective for their customers. As they are providing competitive rates through community banks and credit unions, LendKey can help you find the best possible home improvement loan that fits your budget without the need for any home equity.

Good customer service is most important when it comes to the loan service LendKey providing good customer service across the United States.

If you want to do major renovation to your home or just a small update, LendKey home improvement loans are the best option for turning your dream home into reality. We hope that you have got good information through this article. If you still have some questions or some problems, then you can ask us by writing a comment in the comment box below. We will definitely help you.

Also Read This

How to change the PIN on your ECU Debit Card in the United States: All you need to know about