Hugo Insurance: Let’s get your car coverage in an convenient and inexpensive way.

Nowadays, there are so many insurance companies in the market that people often get confused as to which company’s insurance to buy. Different insurance companies provide a lot of facilities for their customers, and we really get confused as to which policy will be right for us. If we look at the current market conditions, as customers, we should also think in a new way while purchasing any policy so that the policy is convenient for us, affordable and gives full support to the customer.

Nowadays, there have been so many changes in the market that now the market has started adopting more and more convenient, affordable and customer-friendly models, due to which everyone is taking the name of Hugo Insurance.

Hugo Insurance has so many offers for its customers which are very attractive and budget friendly, which give solutions to the problems of the customers.

In this article, we will see what makes Hugo so unique and why its community and popularity is increasing in the country these days. Let’s check!

What is Hugo Insurance?

Why should there not be special insurance that allows its customers to purchase their coverage whenever they want, be it monthly or weekly? Hugo is the solution to this. The insurance industry has witnessed a dramatic shift towards one of the most convenient, affordable and customer-focused models, which has changed names, such as the U.S. insurance status with Hugo Insurance.

Known for its exclusive pay-as-you-go car insurance, Hugo offers an attractive alternative to budget-conscious motorists looking for convenient and easy-to-consume insurance policies as the solution to the problem.

Hugo Insurance is an innovative insurance company focused on providing drivers in the United States with premium auto insurance at any time. Unlike traditional insurers that require long-term commitments and monthly premiums, Hugo never offers a no-month, no-cost credit card that allows drivers to purchase coverage, weekly, or monthly. This flexibility allows drivers to check insurance to activate or pause coverage as needed or enabled.

Using technology, Hugo makes it easy for drivers to manage their insurance policies entirely online, providing affordable rates that suit any budget.

Why choose Hugo Insurance?

Several factors make Hugo Insurance attractive to the U.S. market.

No credit check: Hugo eliminates credit checks from the insurance-buying process, making it easier for people without imperfect credit to get cheap car insurance. Many people get bored with this credit check process, so here it is a bonus option for their customers.

Instant financing: The sign-up process is quick, and drivers can access instant financing through Hugo’s online platform or mobile app. That’s especially useful for individuals who need insurance immediately. You can use this feature any time you want.

No cost:We all know that whatever other insurance companies there are, they mostly take a down payment from the customers and also take advance payment. Along with this, they also want long-term commitment. But that’s not what Hugo is about. You can start your coverage without a large down payment or continue with a monthly payment option.

Pay as you go option: so many customers are attracted to Hugo Insurance because of its unique feature of pay as you go. This option allows drivers to pay only on those days on which customers need coverage.

Basically, this idea is good for people who don’t drive every day or some customers who want coverage for a temporary period.

Pause and resume insurance at anytime customers want: Hugo allows its customers to pause and resume their insurance premiums whenever they want. This feature is good for temporary drivers or for frequent drivers who do not want to pay for insurance when they are not driving their car or when they are not using their car.

Good customer service

Hugo provides good customer service to his customers. If you want to connect to their support team, you can go directly to their website and click on the support option.

How to add your query or questions for which you want support from Hugo.

Hugo insurance coverage options

While Hugo’s focus is on providing convenient and short-term auto insurance coverage, coverage options remain the primary requirements for auto insurance in the US. Drivers can choose from the following:

Liability Coverage Liability insurance is a necessary requirement in the maximum U.S. States, and Hugo offers this essential coverage to help drivers meet the country’s legal guidelines. This consists of: body injury and property damage liability.

Medical Payments Coverage

In the event of a coincidence, clinical payment coverage enables you to pay for medical expenses for you and your passengers, regardless of mistake. This non-compulsory insurance may be especially beneficial for people without entire medical insurance.

Comprehensive and Collision Coverage

While Hugo in most cases markets itself as a simple criminal obligation corporation, similarly they offer options for whole and collision insurance. This greater coverage protects your vehicle in competition from damage resulting from non-collision sports like theft, vandalism, or natural disasters (complete), in addition to damage from injuries (collision).

Roadside Assistance

Hugo consists of an opportunity for roadside assistance, imparting help with flat tires, lifeless batteries, towing, and distinctive minor problems which could leave you stranded on the street. This is a less expensive add-on for people who need greater safety on the road.

Uninsured Motorist Coverage

This coverage option protects you if you are worried about pressure on you related to the inadequate coverage amount. Hugo consists of coverage of their suggestions to provide extra peace of thought for drivers.

How to apply for Hugo Insurance?

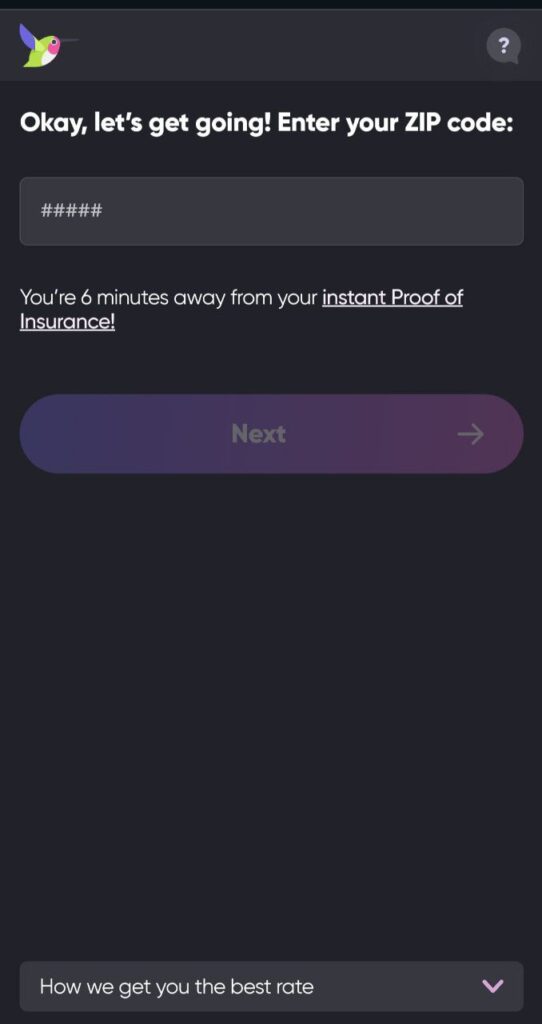

If you also want to apply for this insurance, then you will have to follow the steps given below, which are very easy.

In the first step, you have to go to the official website of Hugo Insurance, where you have to create your account by

sign up option.

To say goodbye to unaffordable premiums, you have to first get your quotes. You can get proof of insurance in under 6 minutes only.

You will get different products option there you have to select which coverage exactly you want.

How you pay for coverage for your insurance

Hugo explains all the process in detail on their official website. You can go there and check. Also, we are providing some information about how you can pay so that it will be beneficial for you.

In the very first step, when you go to the official website there, you will find the option to pay to click on that.

After this, you have to select according to your budget plan for a few days, weeks or a month at a time so that it fits your budget wisely.

You have to spend as much as you drive and only spend one day of coverage at a time on Hugo.

If you want to extend your coverage a bit, then Hugo gives you a few extra days to pay so that you will get peace of mind.

Hugo gives you an overdraft protection option, where if you can’t make a payment now, you can request to cancel it. There, after, you can reload your account when you can afford to drive your car again.

Conclusion

We hope that you have got good information about insurance through this article. If you have any questions or problems, then you can ask us by writing a comment in the comment box below. We will definitely help you. Please share this article with as many people as possible.

Also Read This

Zombie Apocalypse Scholarship: Let’s turn fear of Zombie into funds for education

FAQs

Can I pause my coverage of Hugo?

Yes, one of the key features of Hugo Insurance is the ability to pause and resume your coverage at

Is Hugo Insurance available in all states?

No. Hugo insurance is currently expanding. It is not available in all states. It is developing in some states. You can check their website or app to confirm if it is available in your area or not.