BNY Mutual Funds: A Detailed guide for investors in the United States

In today’s era, many people have become aware of investment, and they have come to know the importance of investment. When it comes to investment, most people prefer to invest in mutual funds and mutual funds have become very popular for investment nowadays, whether it is a new investor or an experienced investor.

BNY Mellon, one of the oldest and most repeatable financial institutions in the United States, offers a wide range of mutual funds designed to meet the essential needs of its investors.

A very long-standing history and commitment to providing high quality investment products, BNY Mutual Funds remains a constant favorite fund among many investors who have become a go to those looking to increase their portfolios and grow their wealth.

In this article BNY Mutual Funds we will explore more about BNY Mutual Funds, exactly how they work and how you can apply to mutual funds and their performances to decide your investment strategy for more profitable returns.

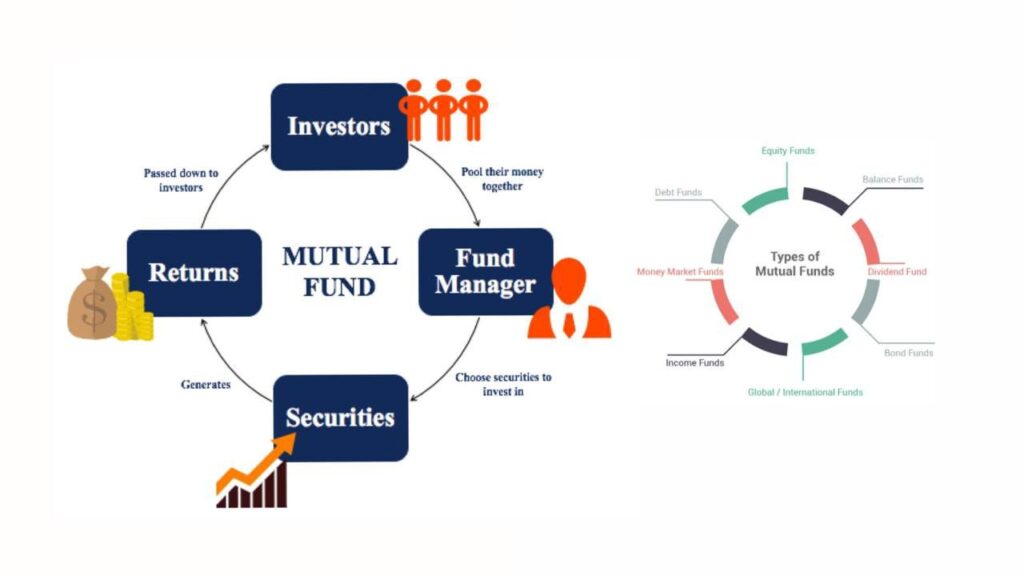

What are Mutual Funds?

Before going to detail about BNY Mutual Funds, first understand what exactly mutual Funds are. Basically, a mutual fund is a type of investment that pools money from multiple investors across the world to invest in a diversified portfolio of assets. Portfolios of assets can be stocks, bonds or other securities. Each investor in the mutual funds owns shares representing a portion of the mutual funds holding. The funds made by investors are generally managed by the fund manager so that the investors can totally rely on a fund manager. They don’t need to worry about where to invest and how to invest.

The good benefit of mutual funds, because of which so many investors are attracted towards mutual funds, is that they offer diversification. That means helping to reduce the risk by spreading investment across various assets so that it will not affect the individual investor. In addition to this, mutual funds are professionally managed with the experience of fund managers for making decisions on behalf of the investors, which can help investors to get peace of mind and optimized return.

BNY Mutual Funds Overview

BNY Mutual Funds, also known as BNY Mellon Mutual Funds, offers a range of mutual funds across different asset classes and investment strategies, allowing investors to choose funds that align with their financial goals, risk tolerance and investment time horizons. As of now, BNY Mutual Funds have a variety of investment products that are highly regarded for their performance transparency and good return and accessibility.

Types of BNY Mutual Funds | Best BNY Mutual Funds

BNY offers over one of all the mutual funds, including stock funds, bond funds, money market funds and many more. We have given an Oreo of some of the major categories of mutual funds offered by BNY.

Equity (stock) Funds

Equity funds are the funds that focus most on investing primarily in stocks and are designed for investors looking to achieve long-term growth. BNY Mellon offers a different range of equity funds, including those focused on specific sectors, geographic regions and investment styles such as growth and value investing.

Best example of BNY Mellon Equity Funds

BNY Mellon Large Cap Stock Fund: This fund focuses on large companies with strong growth potential. This fund considers the large cap companies to be those companies with a market capitalization of 5 billion or more at the time of purchase. It has shared classes of A,C and I.

BNY Mellon International Stock Fund: This fund invests in companies outside the United States, offering exposure to international markets. The investments are made in developed countries of the developed markets such as Canada, Japan, Australia, Hong Kong and Western Europe. It has shared classes of A,C and I.

BNY Mellon Technology Growth Fund: For investors interested in the tech sector, this fund focuses on companies within the technology industry, from startups to established giants like Apple and Microsoft. In this fund, up to 25% of the fund’s assets may be invested in foreign securities. Technology companies with the potential of a strong earning or revenue growth rate are considered. They have shared classes of A, C and I.

| BNY Mellon Large Cap Stock Fund | 19.07(YTD Return) |

| BNY Mellon International Stock Fund | 9.60(YTD Return) |

| BNY Mellon Technology Growth Fund | 19.07(YTD Return) |

Fixed Income (Bond) Funds

Fixed income funds, or bond funds, invest in debt securities, such as government bonds, corporate bonds, and municipal bonds. These funds are typically less volatile than equity funds and provide regular income to investors, making them a good option for those seeking stability or income in their portfolios.

Examples of BNY Mellon Fixed Income Funds:

BNY Mellon Core Bond Fund: This fund invests in a diversified portfolio of investment-grade bonds, focusing on income and capital preservation.

BNY Mellon High Yield Bond Fund: For investors looking for higher returns, this fund invests in bonds with lower credit ratings but higher yield potential.

BNY Mellon Municipal Bond Fund: This fund focuses on tax-exempt municipal bonds, making it ideal for investors in higher tax brackets who are seeking tax-advantaged income.

Balanced and Asset Allocation Funds

Balanced funds combine stocks, bonds, and other securities to offer both growth and income. These funds are designed to balance risk and reward by diversifying across asset classes. Asset allocation funds actively adjust the mix of assets based on market conditions, aiming for a balanced portfolio that suits varying economic environments.

Examples of BNY Mellon Balanced and Asset Allocation Funds:

BNY Mellon Balanced Opportunity Fund: This fund combines equities and fixed income to provide a balance of growth and income.

BNY Mellon Dynamic Asset Allocation Fund: This fund adapts its asset allocation strategy in response to changing market conditions, offering more flexibility in risk management.

Money Market Funds

Money market funds are low-risk mutual funds that invest in short-term, high-quality securities such as U.S. Treasury bills and certificates of deposit. These funds are typically used as a place to park cash or as a temporary investment vehicle during market volatility.

Examples of BNY Mellon Money Market Funds:

BNY Mellon U.S. Treasury Money Market Fund: This fund invests primarily in U.S. government securities, providing stability and liquidity.

BNY Mellon Government Money Market Fund: A safe and secure option that focuses on short-term government-backed securities.

Sustainable and ESG (Environmental, Social, and Governance) Funds

Sustainable investing has become increasingly popular, and BNY Mellon offers several funds that focus on companies meeting certain environmental, social, and governance (ESG) criteria. These funds are designed for socially conscious investors who want to align their portfolios with their values while seeking long-term returns.

Example of BNY Mellon ESG Funds:

BNY Mellon Sustainable U.S. Equity Fund: This fund invests in U.S. companies that demonstrate strong ESG practices, particularly in areas like environmental sustainability, social responsibility, and corporate governance.

BNY Mellon Global Sustainable Opportunities Fund: This fund seeks to invest in companies worldwide that promote sustainability and are leaders in addressing global environmental and social challenges.

How to invest or how to apply for BNY Mellon Mutual Funds

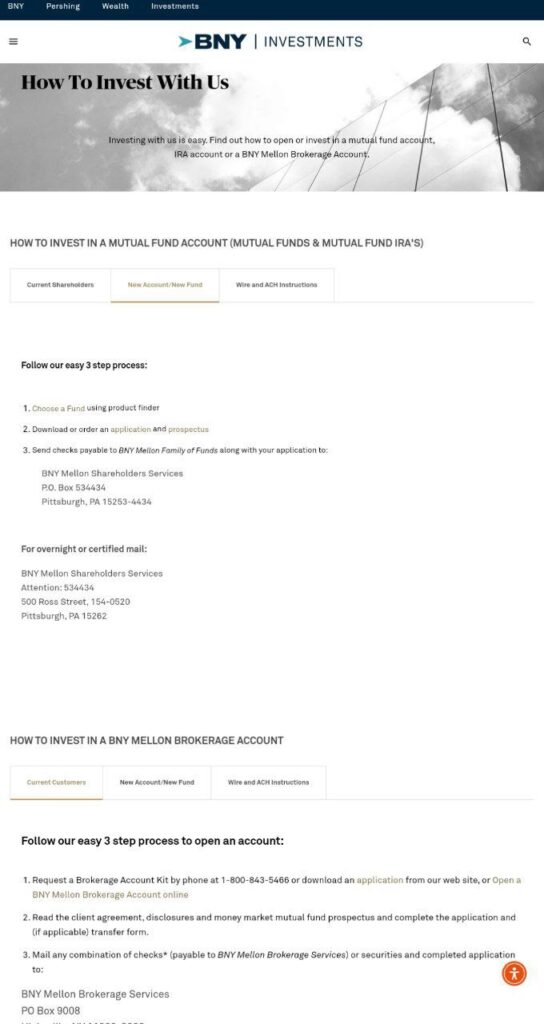

Choose a fund

When you go to the official website we have given the link to BNY Mutual Funds, you will get to know there are multiple funds available with your financial goals and risk tolerance. You can check everything starting from performance history fees and investment objectives of a particular fund on the website. You have to select options as a citizen of a country. Depending on this, they will suggest different funds.

Open account

You can open an account directly through the website. I will just take your personal information, and you can fund your account through bank transfer or other payment methods available on the website.

- You will get three options.

- Current shareholders

- New account on new fund

- Wire and ACH instructions

If you are a new customer, then you have to click on the new account / new fund.

You have to choose a fund using a fund finder.

Download or order and application and prospectus for your detailed information.

Set Investment amount

If your account is open, determine how much you can invest in a particular fund. With BNY, you have the option of choosing the minimum investment requirement. After this send, checks payable to BNY Mellon Mutual Funds family of funds along with your application to

BNY Mellon Shareholders Services

P.O. Box 534434

Pittsburgh, PA 15253-4434

For overnight or certified mail:

BNY Mellon Shareholders Services

Attention: 534434

500 Ross Street, 154-0520

Pittsburgh, PA 15262

Monitor your investment and return

After investing, you have to monitor your portfolio regularly to ensure whether it is performing well and well according to your expectations or not. You can also choose options like re-investing dividends and capital gains to help grow your investment overtime.

Conclusion

Investing in BNY Mellon Mutual Funds can be a smart move for investors looking for good portfolio management diversity and flexibility with good returns. With the variety of options available, Mutual Funds are becoming popular day by day, including equity funds, bond funds and others.

Easily achieve your financial goal with the help of BNY.As with any investment, it is really essential to choose the fund which will be well fit for your financial condition. BNY will tide you throughout this process to manage your portfolio. You can take advantage of the management’s range of strategies designed to help you succeed with good returns. If you have got good information from our article, then you must share this article with as many people as possible and give your feedback in the comment box below.

Also Read This

American Education Services Student Loan Login: A Complete Guide for Borrowers in the United States