AmeriCU Home Equity Loan: A Complete Guide

In today’s modern era, home equity loans have become very popular. People are often looking for where they can get financial help which can improve the economic conditions. Whether you’re planning to renovate your house, consolidated debt or large financial expenses like education or medical bills, home equity loans can offer you the cash you need at good interest rates with good terms.

In this blog AmeriCU Home Equity Loan: A Complete Guide we are going to see what makes AmeriCU home equity loans special and why they may be the right option for you. Let’s go and do some research!

Who is AmeriCU?

AmeriCU is a credit union offering this financial product. This is a well-known institution with a long history of helping many people across the country who want to achieve their financial goals.

AmeriCU is a New York State chartered union located in Rome, New York that began in 1950. The products offered by AmeriCU are savings checking consumer lawns mortgages different credit cards etc you can check all these details on their official website here we have provided link for the same.

What is a home equity loan?

A home equity loan is often referred to as a second mortgage, which allows you to borrow money using the equity you have built in your home as collateral.

If we talk about equity, then equity is the difference between your home and what you owe on your mortgage.

Types of AmeriCU Home equity Loan

AmeriCU offers two main types of home equity loan.

- Fixed rate home equity loan

- Equity line of credit

Fixed rate home equity loan

- A fixed rate home equity loan gives you a lump sum of money which you then repay over a set period that can be 5 years, 10 years or 15 years.

- The interest rate remains fixed throughout the life of the loan.

- This loan option is good for homeowners who need a good sum of money for a specific purpose such as home renovation or debt consolidation.

Home equity line of credit(HELOC)

- We talk about home equity line of credit. Then this actually works more like a credit card. You are given a credit limit based on your home equity, and you can drop from that line of credit as needed over a period. Usually the period is between 5 and 10 years.

- In this period you pay interest on the money you borrow. This period is over, the repayment method begins during which you will start repaying both the principal and interest.

AmeriCU Home Equity Loan Interest Rates

| Term | APR* | Payment per $1,000 |

| 60 months | as low as 5.99% | $19.33 |

| 120 months | as low as 6.49% | $11.36 |

| 180 months | as low as 6.99% | $8.99 |

Eligibility for AmeriCU Home Equity Loan

If you also want to get a home equity loan, then you have to follow certain criteria.

Homeownership

- You must own your home, and it must have sufficient equity. Mostly 80-90% of your home’s appraised value minus what you owe on your mortgages.

FICO score

- To qualify for a home equity loan you will need to have a FICO score of 660 or higher.

Income proof:

- You have to give income proof so that you can afford the loan payments.

Credit Score:

- As we know, almost all lenders will check your credit score. A higher credit score increases your chances of approval.

LTV Ratio:

- LTV Ratio is a loan to value ratio which compares the amount you are borrowing to the appraised value of your home. A lower LTV Ratio is more favorable.

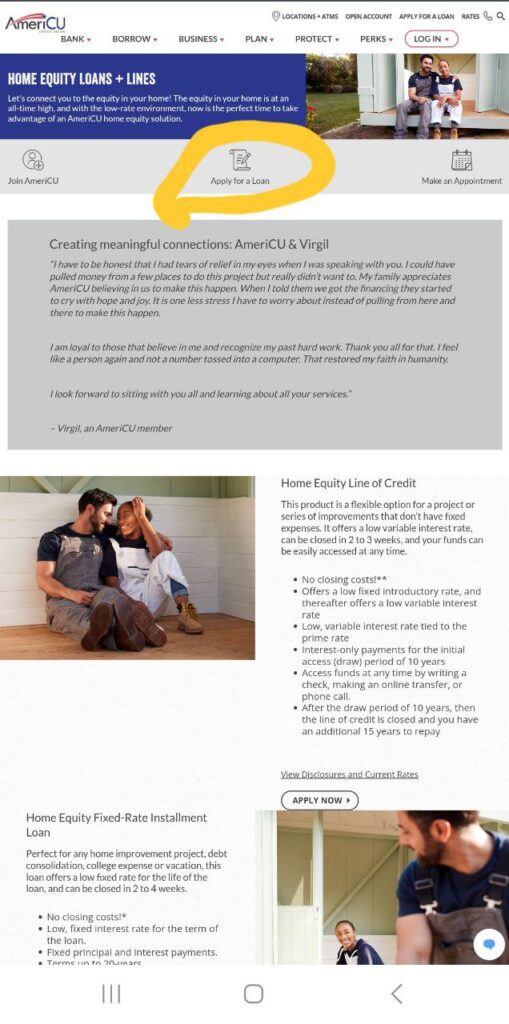

How to apply for an AmeriCU home equity loan?

To apply for an AmeriCU home equity loan is very easy. You just have to follow these steps.

Analyse your financial needs:

Before applying to AmeriCU you have to make sure about all your financial needs. How much you need to borrow and what type of loan fits your situation.

Go to official website:

In the next step, you have to go to the official website of AmeriCU. You have to open the account on the website so that you can login whenever you want.

Go to the borrowing option where you will get a home equity loan. You can check interest rates and everything related to the loan, and you have to click on “apply now”.

Add documents

You have to check all the documents, add them along with all the personal details and submit your application for approval.

Approval and closing

Once your application is submitted, AmeriCU will review it and order and do an appraisal of your home. If approve you will proceed to closing where you will sign the final documents and receive the loan funds.

Benefits of AmeriCU Home Equity Loan?

- No closing cost:

The closing cost associated with AmeriCU is zero, which means they will not take any closing cost when you are going to close your equity loan.

- Great low rates:

The rates associated with equity loans are very low. Anyone can afford to pay. Basically home equity loan fixed interest rate that may be lower than other types of loan regular monthly payment.

- Quick to close, usually in 2 to 4 weeks:

When you want to close the loan, you can easily close your loan. This process is very fast. It usually takes 2 to 4 weeks. If your loan is approved your funds will be available within 3 business days after you close with no closing costs

- Simple mobile friendly applications:

AmeriCU has a user-friendly application. Anyone can easily understand how to navigate between menus in the application.

Conclusion

Home equity loans from AmeriCU can be a smart financial tool for homeowners who want to tap into the value of their property. In today’s era, taking a loan has become a big deal because the interest rates have increased so much that a common man cannot afford it.Therefore, before taking a loan, we should think and analyze everything.

The facilities provided by AmeriCU help you to achieve your financial goal. Before you apply, you have to understand the terms and conditions and multiple loan options available and which option best fits your own financial plan.

Disclaimer

Investments and loans are subject to market risks. Always consult a financial advisor before making any financial decision.

Also Read This